A largely Internet-based movement called Bank Transfer Day (BTD) culminated on Nov. 5 in thousands of consumers switching their bank accounts from large for-profit banking institutions to smaller and more localized credit unions.

BTD arose out of the frustration many consumers felt towards financial institutions for a slew of perceived grievances banks enacted upon their customers, such as the relatively infamous Bank of America Corp. debit card usage fee announcement.

Many large for-profit banks have been seeking new ways to earn profits after the Durbin amendment cut many of their revenue-generating mechanisms that were deemed superfluous.

The BTD movement has relied heavily on social media to draw attention to an issue that has struck a chord with a growing number of Americans.

The Facebook page for the event, which seems to be the driving force behind it, flaunted 85,790 attendees and over 700,000 invitees. At the same time, the movement itself hosts a Facebook page with 58,808 “likes.”

Attendance and “likes” for both the event and the page have been fluctuating with a general upward trend since small business owner Kristen Christian from Southern California created the event.

The actual number of bank account transfers is still unclear, however support for credit unions has been rising rapidly in recent months.

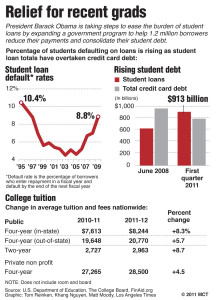

Since roughly late September, about 650,000 consumers have joined credit unions, according to a survey conducted by the Credit Union National Association (CUNA). For comparison, Time Magazine maintains that over the entire span of 2010 that number was only 600,000 new customers.

While BTD is not directly affiliated with either Occupy Wall Street or Anonymous according to its event page, the general ideology and frustration expressed towards banks ties in to both movements/groups.

All three entities do however share the same common fascination and use of Guy Fawkes imagery most recently popularized by the mask worn by the protagonist in the movie “V for Vendetta.”

The date for BTD happens to fall not coincidentally on Guy Fawkes Day, a British holiday commemorating the spoiling of a plot, involving Fawkes, to blow up the Houses of Parliament in protest of intolerance for Catholics in England at the time.

The Fawkes imagery is rather apropos considering it is a representation of anger felt by those in relatively powerless positions who use unorthodox methods against a ruling system that is comparable to the current frustration of many Americans.

Despite reaching thousands of people through social media, an article in the Wall Street Journal argues the impacts of this financial migration may be relatively limited on for-profit banks.

According to the article this is because, “People who gravitate to credit unions tend to be unprofitable for giant banks because of the small balances they keep on deposit, low number of products they buy and the relatively high account-maintenance expenses at big financial firms.”

Even though the impact may be limited, the message of frustration from a growing number of Americans is clear and much of that ire is being directed at large banks.

Still, for college students, credit unions may represent a smarter financial choice in general regardless of the current zeitgeist against for-profit banks.

“The results indicate that consumers are clearly making a smarter choice by moving to credit unions where, on average, they will save about $70 a year in fewer or no fees, lower rates on loans and higher return on savings,” stated CUNA President/CEO Bill Cheney in an article released by the association.

Needless to say, $70 goes a long way for the average college student who can ill afford to waste money.

At least some for-profit banks are beginning to feel the heat as BofA sent out a press release stating it would no longer put into effect the debit usage fee of $5 it had originally planned to implement. This came largely in response to customer concerns and changing expectations for the market according to BofA.

However, for BofA and the rest of the industry, the damage may have already been done. It will be hard to beat the overriding sense many Americans seem to hold that banks will find other ways to charge their customers.

“I would not be surprised if [banks] found a way to sneakily take money out of people,” said Kyle Sloane, who is a graduate student in Biostatistics at CSU East Bay.

For now it remains to be seen how or if BTD will impact America’s financial structure, but it clearly shows growing momentum to challenge the way things are run in the United States in conjunction with the various Occupy movements and Anonymous.