Although President Barack Obama drew attention to the recent upturn of the economy in his State of the Union address, experts say accumulated student loan debt can potentially put a damper on students’ future investments.

The housing market collapse in 2008 has made it even more difficult for students, and the need for immediate credit upon graduation requires college students to begin preparing for future financial freedom their sophomore year of college.

Bay Area real estate broker Lisa Craig says the possibility of students being able to afford a home a few years out of college is minimal due to the necessary loan qualification requirements.

“To be qualified for a home loan […] I would say that you need […] 24 month[s] of established credit on four minimum trade lines,” she said. “You need to establish four accounts and keep them within 30 percent of the credit limit. Because if you go over that […] you are considered a higher risk […] and that’s going to lower your credit score.”

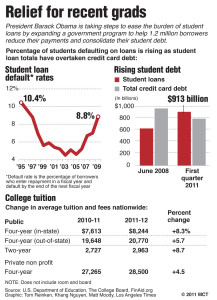

Federal Reserve consumer debt statistics show that student loan debt trumped revolving credit card debt by at least $3.5 billion in 2010, according to an article by FastWeb.com.

Several students expressed concern for the increase in college tuition in the past five years, but still feel a post-secondary education is vital for their futures.

The dilemma many have considered is whether or not the positives of attending college outweigh the negatives.

Overall, obtaining a college education is considered to be positive by the general public, yet the accompanying debt accumulated along the way is not.

According to the USA Today “Young & In Debt” study, the average balance of student loan debt has been on the rise for some time now.

Within the last 10 years, the nation has witnessed a 16 percent increase in average student loan debt while revolving debt, including credit cards, rose by nearly 24 percent.

Given these statistics, the promise of a quick financial recovery following the “wonder years of college,” as described by Kaiser Permanente psychologist Dr. Andrea Green, is unrealistic.

Green admits she was not ready to purchase a home after college for quite some time, because the amount of student debt she accrued was far too large and the amount of income she received from her first job after graduation was not sufficient enough to afford a mortgage payment.

Despite the economic hardships students face after graduation, experts say young people do have the advantage of foresight in knowing what pitfalls have hindered those before them.