Congress’s Deadline to Raise Debt Ceiling Approaching with No Agreement in Sight

September 29, 2021

The Economy Faces Potential Damage if Debt Ceiling Agreements are not Reached in Time

The end of the government’s fiscal year is Sept. 30, a date that will arrive in a blink of an eye. If congress does not come to an agreement to raise the country’s spending limit, also known as the debt ceiling, the U.S. will default on its debt, causing a government shutdown and other economic concerns.

Since the federal government is the largest employer in the U.S., a shutdown could, “lead to a significant reduction in consumer spending if employees who are temporarily let go believe the income loss is permanent,” according to Christian Roessler, associate professor in the Department of Economics at California State University, East Bay. It’s no secret that job insecurity forces consumers to be more careful as to how they spend their money, and for a struggling economy, consumer spending is vital.

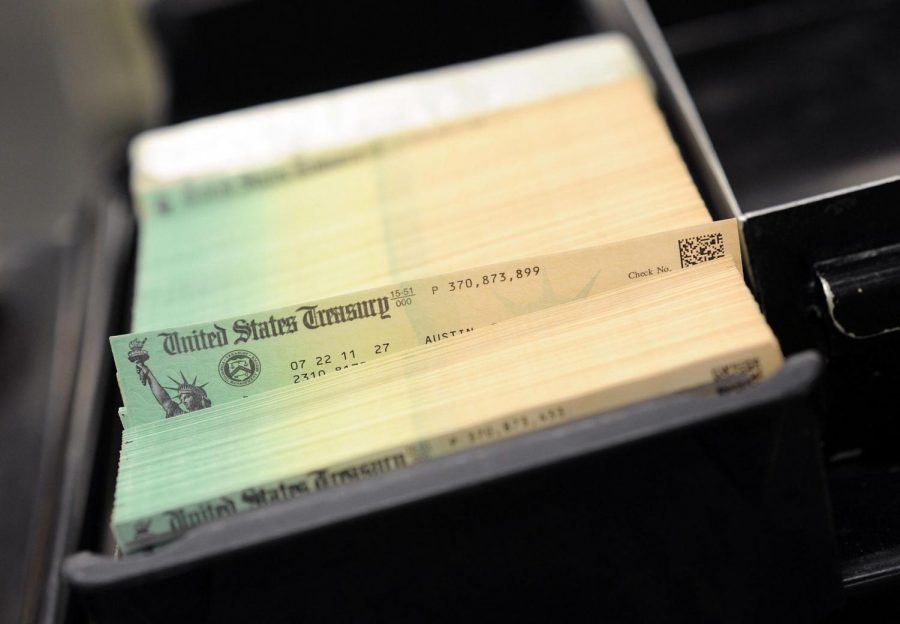

A government shutdown would also affect government services, causing a delay in processing permits and licenses. Regardless of the outcome of debt ceiling negotiations, Social Security benefits would not be affected, according to the president of Social Security Works, Nancy Altman. However, a delay in how quickly those checks are sent out could still occur.

The U.S. falling on a default would also affect the, “perceived creditworthiness of the U.S government- the likelihood that we will serve our enormous debt to domestic and foreign citizens and entities- affects global financial markets,” Roessler added.

Roessler explained that while a shutdown would show the government’s commitment to keeping the debt manageable, it would also highlight how unsustainably high government spending truly is, as well as providing an image of our inability to raise sufficient funds to service it.

Such an image would concern financial markets, and according to Roessler, they could interpret it as a, “sign of instability that could translate into higher risk premia on government debt, and a lesser willingness to conduct transactions in dollars, which would devalue the dollar relative to other currencies.”

Recently, the House of Representatives passed legislation to lift the debt ceiling so that the government could cover its expenses, but there are concerns that the legislation will fail to pass the Senate due to Republican opposition.

Opposition that comes from Republicans not wanting to increase the federal borrowing limit that would allow President Biden’s 3.5 million dollar human infrastructure plan to pass through the budget reconciliation process, a process that wouldn’t require Republican votes to pass, due to a Democratic majority.

As congress continues to play political chess, the jobs and paychecks of thousands hang in the balance while the clock continues to tick and the deadline approaches.