The process of becoming an independent

November 3, 2017

Acquiring healthcare as a high-risk patient

At the age of 12 I was diagnosed with Type 1 Diabetes. During three days in the hospital, I learned how to calculate insulin dosages, give myself shots and check my blood sugar: all of which had now become necessary for me to live.

Given how painful they are to use on a daily basis, my family and I immediately began researching alternative methods of insulin delivery to replace the needles I would use five to six times a day.

We discovered the Insulin pump, a cell phone sized device that attaches to your body and for three days at a time, delivering insulin periodically as well as providing additional dosages as needed. But the pump was costly: they cost about $5,500 and the supplies used to attach it to my body and refill it with insulin can cost around $100 per month, according to a 2014 article by Diabetes Self-Management.

In March of 2010 the Patient Protection and Affordable Care Act (ACA) — Obamacare — was implemented into the American healthcare system, according to the U.S. Department of Health and Human Services. The ACA extended the duration a dependent could stay on their parent’s insurance from the age of 18 to 26. For those with illnesses that heavily rely on health insurance — people like me — the process of seeking healthcare after turning 26 is a constant topic of conversation between my doctor and myself.

Growing up, I was completely reliant on my parent’s health insurance to pay for everything I needed for my diabetes. But now that I’m in my fifth year in college and 24 years old, I’m feeling the pressure. Even if I were to have a part or full time job along with the classes required to graduate, I still wouldn’t be able to afford my health care costs out of pocket.

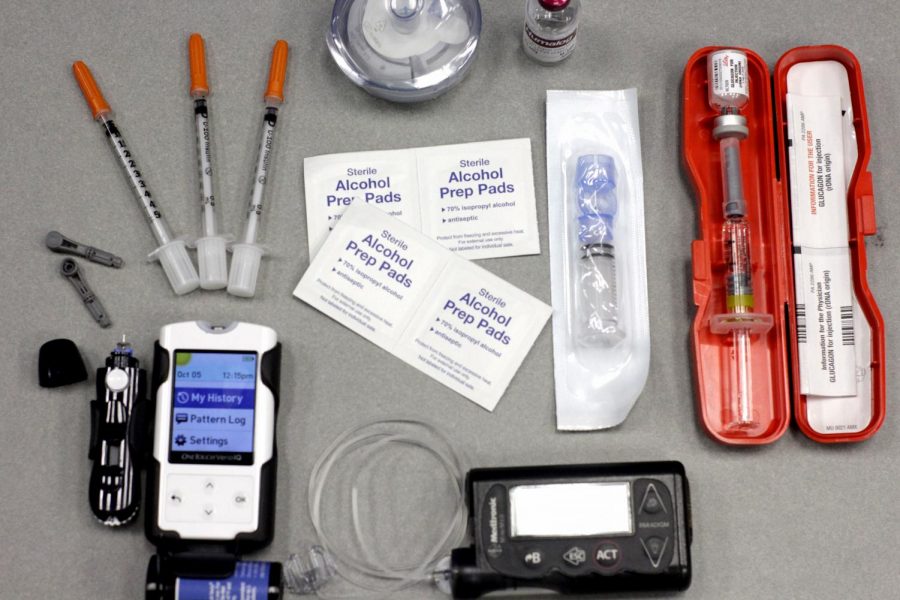

I need many supplies to maintain my diabetes: bottles of insulin, a cartridge to fill my insulin pump, the item used to attach the pump to my body and needles in case the insulin pump fails. I spend approximately $700 for three-month shipments of these items. Without healthcare coverage, my cost could be as high as $1800, a 160% increase. This does not include costs of doctors visits, shipment fees or pharmacy fees.

A Cal State East Bay Communication department staff member who wishes to remain anonymous told the Pioneer she does not identify as a high-risk patient and takes two types of medications to help her cope with Anxiety Disorder and PTSD. She requires those medications for the duration of her life, but she could not afford it without medical coverage. She first acquired healthcare as an in independent through the United States Army Reserve and now receives coverage through CSUEB. Although she does not identify as a high-risk patient, like myself, functioning normally would be more difficult without these prescriptions.

One option for those living in California, high risk or not, is Covered California, a virtual marketplace for residents to use to purchase health insurance. In 2010 California became the first state to create an insurance exchange that allowed approximately 5 million uninsured california residents to purchase health insurance, according to a 2014 article by SFGate.

Covered California consists of 11 health insurance companies such as Anthem Blue Cross, Kaiser Permanente and Health Net, according to the Covered California website. When I turn 26 in the Fall of 2019, I will apply for coverage through Covered California, because it will provide the coverage I need considering the low income I’m expecting to report each year.

The American Health Care Act (AHCA) was introduced on March 20, 2017 placement of the ACA. A number of companies in the medical industry are protesting the bill because it would, among other changes, allow people with pre-existing conditions, like type 1 Diabetes, to be charged higher prices, according to the American Diabetes Association.